IRA assets cannot be left in an IRA forever. You know that – as many of our retired clients take an annual Required Minimum Distribution (RMD). Where it gets complicated, especially with recent SECURE Act guidance, is when you inherit an IRA. Not only do we help clients navigate these complex rules, we do it with tax efficiency at the forefront.

Before the SECURE Act was passed on December 20, 2019, beneficiaries who inherited an IRA from someone other than their spouse were required to use an IRS table to calculate how much they had to withdraw annually from the inherited IRA. They had the ability to “stretch” out RMD payments over their lifetime. Now, with the SECURE Act in place, there is a 10-year rule, meaning that ALL inherited money from an IRA MUST be withdrawn within 10 years from the death of the original IRA owner. This rule went into effect for deaths beginning in 2020.

For the past few years, there was some confusion over HOW the 10-year withdrawal was required to be done. Did beneficiaries of inherited IRAs have to take 1/10th of the IRA’s value as an RMD each year? Was any RMD, at all, required before the 10th year? The IRS was silent in terms of guidance until just a few months back.

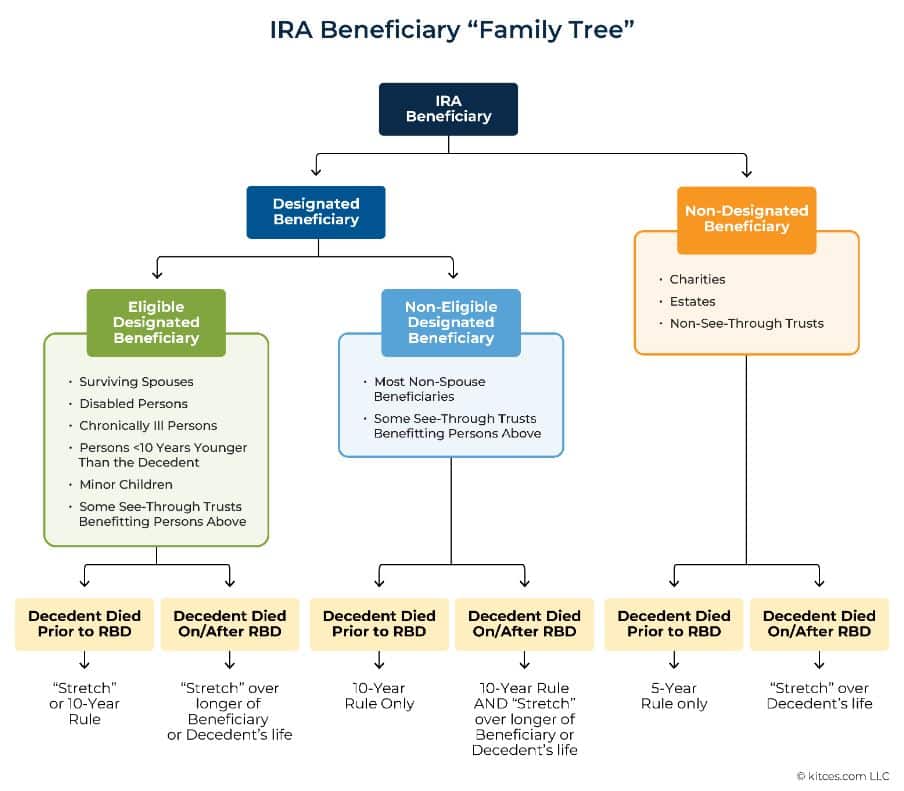

On July 18, 2024, the IRS issued some clarification on RMDs for beneficiaries of qualified plans, including IRAs. See the IRA Beneficiary flow chart below explaining the options for beneficiaries of qualified plans below. Because you work with us, you don’t need to be conversant in the guidance. You do need to know that we will discuss options with you, especially since there are tax implications.

Source: Kitces.com, August 2024

If you are wondering how decisions around taking inherited IRA RMDs impacts your tax situation, here are a few examples.

Let’s consider a client who inherited an IRA from their mother, and who will be retiring in two years. While they are working, they don’t have a lot of control over their income as they earn a salary. If they are considered a Non-Eligible Designated Beneficiary and their mom died before her Required Beginning Date, they have the option to take money at any point, if it all comes out of the account by the end of the 10 years, (see “Designated Beneficiary” diagram).

Source: Kitces.com, August 2024

They can use this opportunity to delay withdrawals until they they are retired, and then take money out of the inherited IRA when they are retired. In this way, they won’t have to worry about extra IRA withdrawals during their working years, which would have potentially pushed them into a higher tax bracket. It could mean the difference between being in the 12% tax bracket vs. the 22% tax bracket.

Now let’s consider that the same client, who inherited an IRA from their mom, is not planning to retire any time soon. If they follow a standard interest calculator to determine the RMD needed for their 10-year withdrawal period, it will essentially require her to withdraw a small amount for years 1-9, and then the bulk of the money in year 10. If they only withdraw the required amount, they will be stuck with a large balloon payment in year 10. This could easily push them into a higher tax bracket in year 10. Instead, they could consider withdrawing more money in years 1-9, so that they won’t have the large taxable distribution to contend with in year 10 and can effectively manage their tax bracket along the way.

These are just two examples of many. On the flip side, there is planning for your IRA to BE inherited by your loved ones. There are ways to mitigate taxes there as well. We love helping clients navigate tax planning, so please do not hesitate to ask us about this if you have an IRA or an inherited IRA.

IMPORTANT DISCLOSURE INFORMATION

*Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Stephens Wealth Management Group [“SWMG”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from SWMG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to their individual situation, they are encouraged to consult with the professional advisor of his/her choosing. Neither SWMG’s investment adviser registration status, nor any amount of prior experience or success, should be construed that a certain level of results or satisfaction will be achieved if SWMG is engaged, or continues to be engaged, to provide investment advisory services. SWMG is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the SWMG’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://stephenswmg.com/. Please Note: SWMG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to SWMG’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a SWMG client, please contact SWMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.