What a time we’ve had in the Year of Estate Planning. It seems like just yesterday that we were putting the final touches on our plans. The year would not have been nearly as impactful without the strong engagement of clients. As an ode to the Year of Estate Planning, the following are some of the resources provided throughout the year.

We began the year with a short document that included the definitions of common estate planning terms. We also sent a letter to clients with information about which estate planning documents we had on file and which we did not. From that effort, we were able to review and store several new estate planning documents and ensure that accounts were titled according to each client’s wishes.

From there, we invited clients to an informative webinar with author and financial planning  journalist Cameron Huddleston on how adult children and parents can better discuss estate planning topics. Here is a link to the webinar and to her book Mom and Dad, We Need to Talk.

journalist Cameron Huddleston on how adult children and parents can better discuss estate planning topics. Here is a link to the webinar and to her book Mom and Dad, We Need to Talk.

Throughout the year, we provided clients with a copy of our Legacy Organizer. The Organizer is a simple communication tool for you and your family. Here is a preview of the document: Legacy Organizer. If you would like a hard copy of the Organizer, please let us know.

Throughout the year, we provided clients with a copy of our Legacy Organizer. The Organizer is a simple communication tool for you and your family. Here is a preview of the document: Legacy Organizer. If you would like a hard copy of the Organizer, please let us know.

We wrote several articles about estate planning topics. These include information about probate court, updating your estate plan, use of a Trustee, and more. Our estate planning webpage serves as a good tool to find these articles, amongst other resources.

Our Client Appreciation event included a speaker from Fidelity’s Center for Family Engagement. He spoke about the importance of family conversations and provided tips and tools for families to use. SWMG Wealth Advisors, Jessie and Jill, provided a recap of the event, as well as a handout.

There was tremendous forward movement made my many families – establishing documents for the first time, engaging with family around future wants and needs, and completing more advanced tax planning, to name a few.

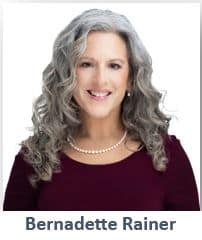

Internally, we welcomed a new SWMG team member, Bernadette Rainear. She joined us in late June as a Senior Client Relationship Associate and 401(k) Program Manager. Prior to joining SWMG, Bernadette worked for another wealth management firm in their operations department. She has a can-do attitude and a wicked sense of humor. Bernadette has already made a big difference in our 401(k) program.

Internally, we welcomed a new SWMG team member, Bernadette Rainear. She joined us in late June as a Senior Client Relationship Associate and 401(k) Program Manager. Prior to joining SWMG, Bernadette worked for another wealth management firm in their operations department. She has a can-do attitude and a wicked sense of humor. Bernadette has already made a big difference in our 401(k) program.

This fall Jill and Jason were promoted to Senior Wealth Advisors, a title that reflects their dedication to continuous learning, knowledge in complex client situations, and demonstration of their advanced skillset. They also earned their Certified Exit Planning Advisor (CEPA®) designation to support business owners in their exit/succession planning. Congratulations to both Jason and Jill on these well-deserved promotions!

Last month was an exciting one for the Stephens Wealth Management Group (SWMG) team, with several notable speaking  engagements on the agenda. Sherri presented at the University of Michigan–Flint School of Management 50th Anniversary Business Summit, where she addressed an audience of business owners. Flint native Ray Scott, President and CEO of Lear, served as the keynote speaker, offering valuable insights.

engagements on the agenda. Sherri presented at the University of Michigan–Flint School of Management 50th Anniversary Business Summit, where she addressed an audience of business owners. Flint native Ray Scott, President and CEO of Lear, served as the keynote speaker, offering valuable insights.

As part of a panel, Sherri shared effective strategies and real-world case studies focused on helping business owners navigate the complexities of generational ownership transitions. This panel offered attendees actionable insights to manage the challenges of succession. We extend our gratitude to Dr. Yener Kandogan, Interim Provost and Vice Chancellor for Academic Affairs, Interim Dean of the School of Management, and Professor of International Business, along with the entire UM-Flint School of Management, for organizing this impactful event.

Sherri and Kim Waldman, SWMG COO, were featured speakers at a Raymond James (RJ) conference for independent advisory firms like ours. Sherri facilitated the executive town hall, where conference participants were encouraged to ask questions of RJ Leadership, to include Chair and CEO Paul Reilly, Vin Campagnoli – Executive Vice President of Technology and Operations, and Greg Bruce – Head of the RIA & Custody Services division. Kim served on a panel of COO’s providing insight in three key areas – human capital management, business growth, and technology.

As we approach the end of the year, the SWMG team has wrapped up another successful  Fall4Fitness event with the Greater Flint Health Coalition. Nearly all of the (SWMG) team members completed over 1,000 minutes of exercise throughout October. Leading the way was Kari Harber, who logged an impressive 2,194 minutes—that’s an average of 70 minutes per day! Congratulations to the entire team on their dedication!

Fall4Fitness event with the Greater Flint Health Coalition. Nearly all of the (SWMG) team members completed over 1,000 minutes of exercise throughout October. Leading the way was Kari Harber, who logged an impressive 2,194 minutes—that’s an average of 70 minutes per day! Congratulations to the entire team on their dedication!

We are also proud to sponsor the 4th Annual Festival of Trees,  presented by the Junior League of Flint (JLF). For this event, our team created a festive holiday wreath inspired by Gilmore Girls. The JLF is committed to educational and charitable work, focusing on the health, education, and well-being of women and children, with particular emphasis on foster care, human trafficking, and domestic violence. Proceeds from this event go right back into our community to support the Junior League’s mission, including Clara’s Hope, Whaley’s Journey Home, and the Whaley’s Children Center. Be sure to visit the 4th Annual Festival of Trees, running from November 8 through December 1!

presented by the Junior League of Flint (JLF). For this event, our team created a festive holiday wreath inspired by Gilmore Girls. The JLF is committed to educational and charitable work, focusing on the health, education, and well-being of women and children, with particular emphasis on foster care, human trafficking, and domestic violence. Proceeds from this event go right back into our community to support the Junior League’s mission, including Clara’s Hope, Whaley’s Journey Home, and the Whaley’s Children Center. Be sure to visit the 4th Annual Festival of Trees, running from November 8 through December 1!

IMPORTANT DISCLOSURE INFORMATION

*Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Stephens Wealth Management Group [“SWMG”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions.

Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from SWMG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to their individual situation, you are encouraged to consult with the professional advisor of your choosing. Neither SWMG’s investment adviser registration status, nor any amount of prior experience or success, should be construed that a certain level of results or satisfaction will be achieved if SWMG is engaged, or continues to be engaged, to provide investment advisory services. SWMG is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the SWMG’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://stephenswmg.com/.

Please Note: SWMG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to SWMG’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Please Remember: If you are a SWMG client, please contact SWMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.