Business owners are always keeping multiple balls in the air. Thinking about exceptional execution today, while keeping an eye on their vision for the future. With that in mind, we recommend that business owners consider both formal and informal processes to understand the value of their business. Why? Whether you are ready to formally think …

Read MoreInsights into probate court The Ins and Outs of Probate Court, which could become a part of your heir(s) future whether you have a trust, a will, or something else – and provide tips to support your heirs. Probate involves the court-managed distribution of assets. In some cases, there are things you can do to …

Read MoreIt may or may not be a problem you would like to have, but for the first time, we have a potential solution for you. As always, there are rules, so not all situations will work. That said, there is a new option to roll over unused 529 money to a Roth IRA. A few …

Read MoreIt is a good idea to review your credit report on an annual basis. Why? First, when you review your credit report, you may find opportunities to improve your credit score. Second, to identify signs of identity theft. Are there credit cards or loans open under your name with which you are not familiar? Third, …

Read MoreThose words can strike fright, or at least trepidation, into many of us. In this case, we mean talking about family values and our wishes as we get older, and eventually pass. Having family or one on one conversations about the future is an important, but often overlooked, part of financial and estate planning. To …

Read MoreMany of you may be aware of the potential tax planning changes on the horizon coming in 2025 to estate-tax rates. Most people are unaware, however, of some of the other tax-cuts that sunset at the end of 2025 if there is no action from Congress and the President to renew them. These tax cuts …

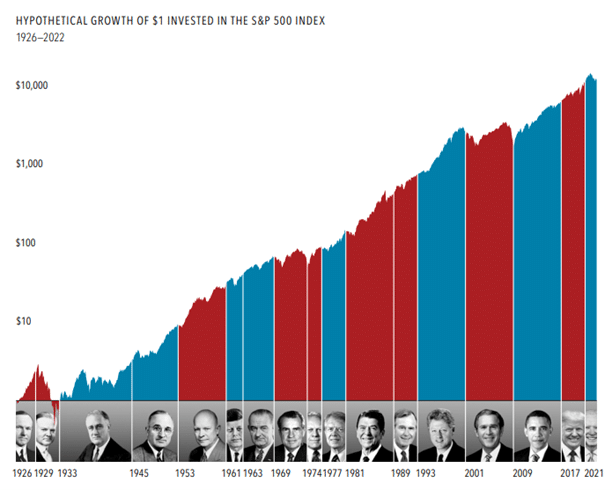

Read MoreLast year was a surprisingly strong year for the stock market driven by moderating inflation and an AI (artificial intelligence) boom. However, 2023 was really a tale of two markets, with mega cap technology stocks having much stronger performance than the rest of the markets. The S&P 500 was up about 26% for the year. …

Read More2023 Highlights As we bring yet another year to a close, our team collectively reflected on the work we’ve done on behalf of and in partnership with clients in 2023. It has been a year of significant change for some – some of the 2023 highlights include clients selling businesses, losing a parent or spouse, …

Read MoreFinancial Advisor, Jill Carr When people hear I am a CPA or that I have worked for the IRS, I usually get questions. Taxes are a universal thing that many people worry about, and few people understand how they work. In this article, I’ll do my best to demystify some common tax concerns and misconceptions. …

Read MoreFor anyone who has a health occurrence or is caregiving for a family member or friend, we were recently referred to a company called Concierge Care of Florida. From a service perspective, they provide the following: Companionship Homemaking (meal prep, laundry, light housekeeping) Transportation for errands/appointments Personal care (bathing, grooming, hygiene etc.), Medication management Alzheimer’s …

Read More